Let’s define the jargon that is used in the tutorial.

Vbv stands for “verified by Visa.” A related term is “mscs,” which means “MasterCard Secure.” Fraudsters never use the phrase “3D security” for that type of payment protection. They always use the acronym “mscs” for Mastercards or “vbv” for Visa cards. One of the basic characteristics of stolen credit cards sold in the darkweb is the piece of information whether the given card is vbv/mscs or is no-vbv/mscs. Presence or absence of such protection changes the carder’s tactics in card usage. Carding with mscs or vbv requires much more knowledge and effort, while no-vbv and no-mscs are much easier in carding.

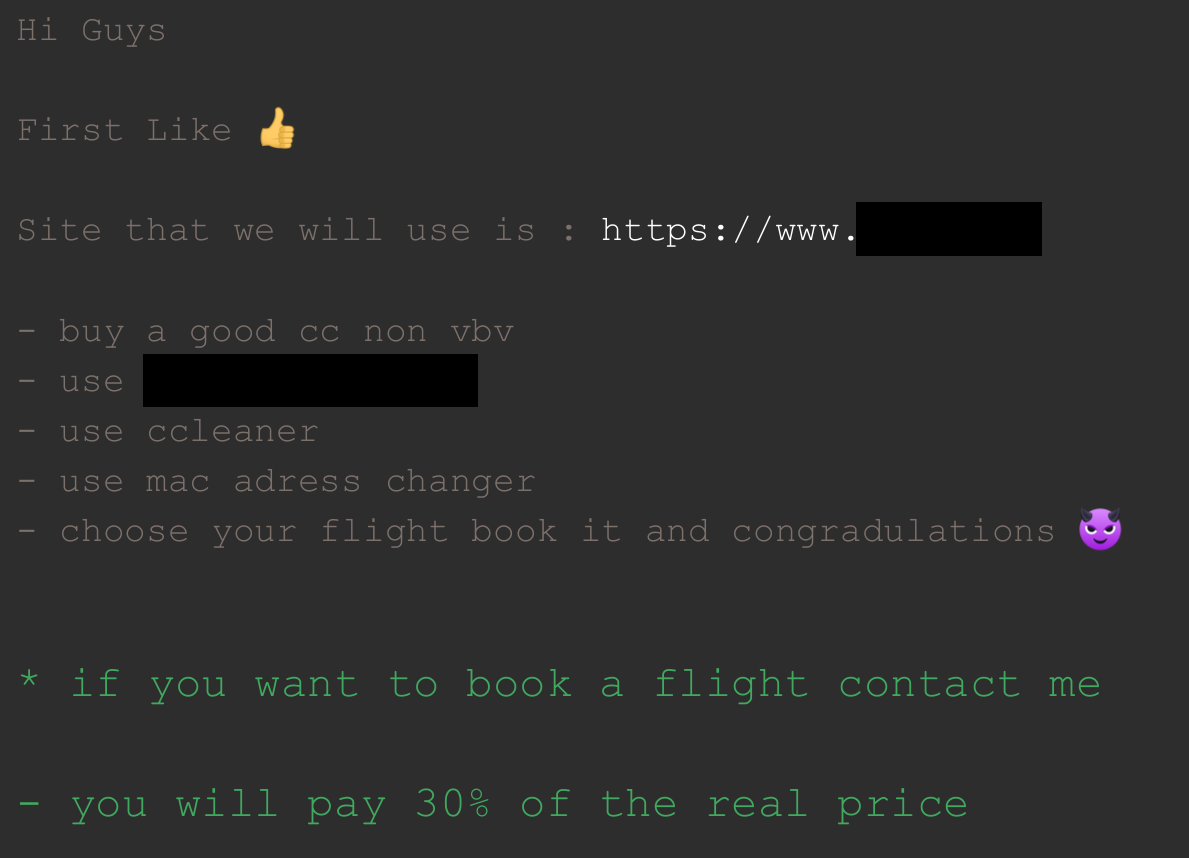

So “buy a good cc non vbv” means purchase stolen credit card information from a “vendor” that sells individual credit cards and batches on the darknet or Clearnet. Forums have lists of such vendors, or a newbie can just turn to Twitter, Telegram, Discord, or atshop to find others.

The tutorial also recommends “Use ccleaner.” CCleaner is a helpful (and legal) tool for carders to clean their browsing history, cookies, temp files, etc. It isn’t some exclusive tool for online criminals (although there are a number of those available)... It’s actually widely available to consumers. According to the CCleaner web site, “Advertisers and websites track your behavior online with cookies that stay on your computer. CCleaner erases your browser search history and cookies so any internet browsing you do stays confidential and your identity remains anonymous.”

Another tool mentioned in the tutorial is “MAC address changer.” MAC stands for Media Access Control. It is the unique address of every Network Interface Card or Controller (NIC).A MAC address changer allows you to change the MAC address of an NIC instantly. You can see why this would be useful to carders that are trying to cover their tracks. The NIC allows computers to communicate over a computer network, either by using cables or wirelessly. The NIC is both a physical layer and data link layer device, as it provides physical access to a networking medium and, for IEEE 802 and similar networks, provides a low-level addressing system through the use of MAC addresses that are uniquely assigned to network interfaces.