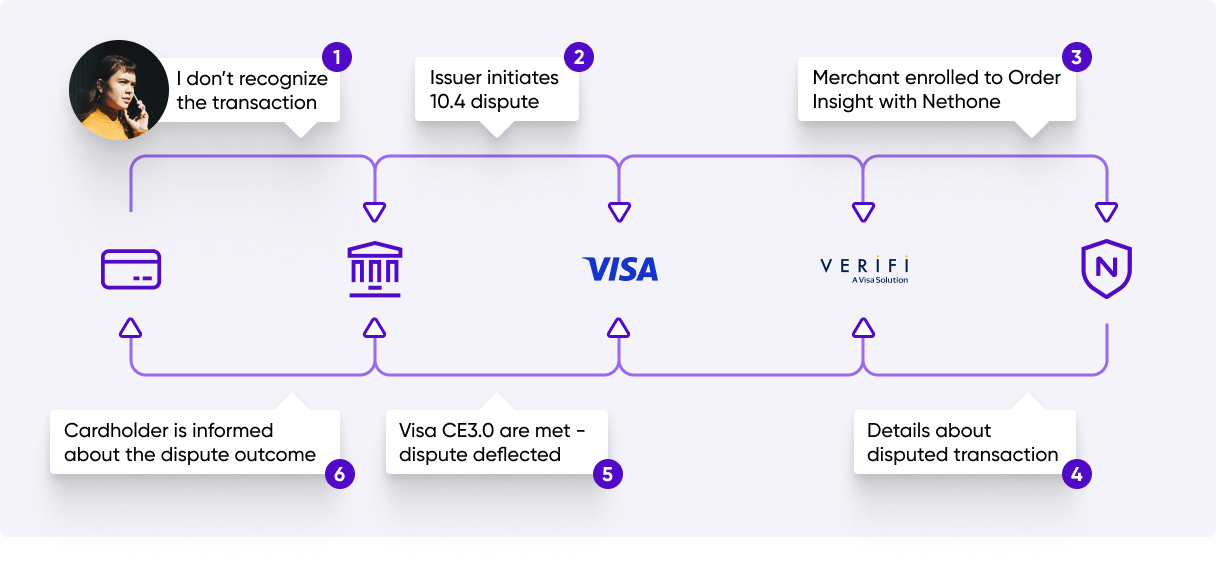

Order Insight is a vital link in the dispute resolution process by establishing a real-time data exchange between you and the issuers via APIs.

When cardholders question their transactions, they contact their issuer that in turn uses Order Insight to request transaction details from Visa. This request is then relayed to Verifi, who communicates with the merchant to retrieve the necessary purchase details. Once collected, this information is shared with the issuer via Visa. The issuer reviews these details with the cardholder to determine if a dispute is necessary, helping streamline the resolution process.

Source: verifi.com

Source: verifi.com

Why acting pre-dispute is crucial

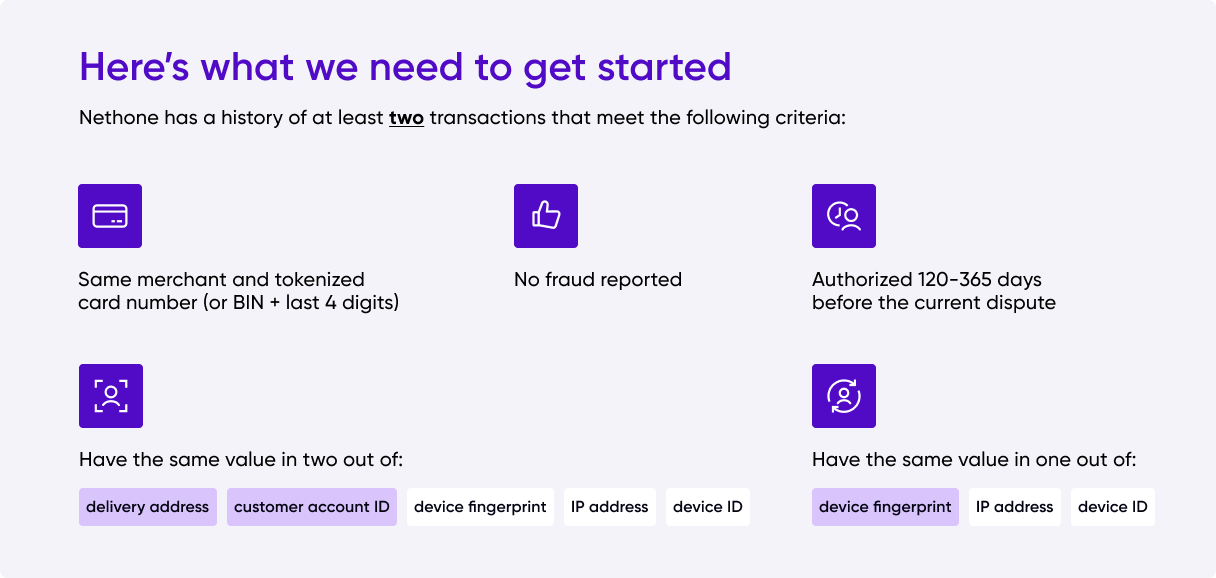

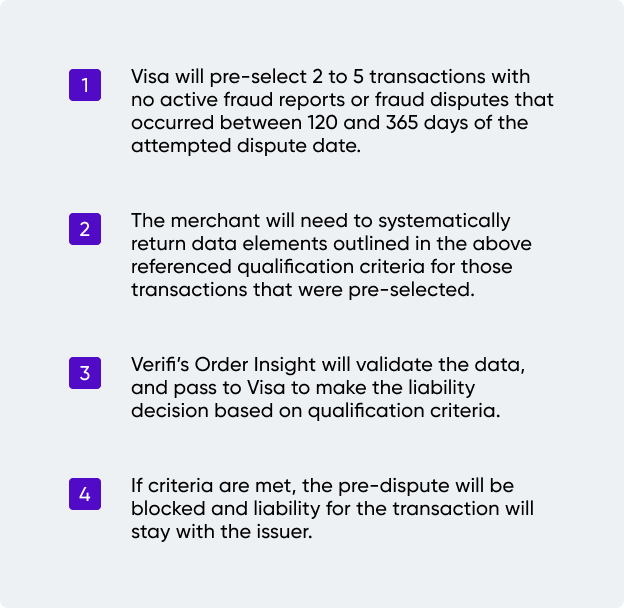

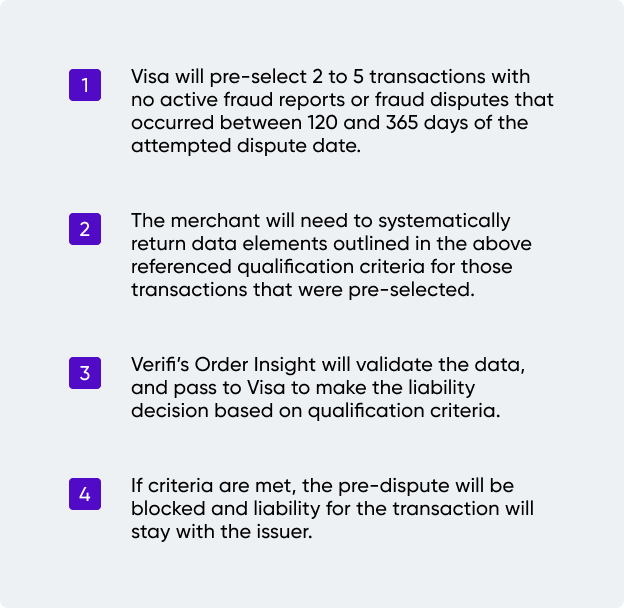

In the past, merchants could only deal with disputes after they had already become a problem. This process involved working with your payment processors to respond to these issues. Thanks to new compelling evidence rules, you can share more information about past transactions. In the pre-dispute stage, this information is exchanged, and the rules are applied before the dispute is fully submitted and processed by Visa. Moreover, when a dispute is prevented using these CE3.0 rules, it doesn't count against your dispute ratio. This distinction sets apart pre-dispute from post-dispute actions.

What happens in the post-dispute stage?

Considering the new rules, the acquirer should send a special form called a VROL pre-arbitration questionnaire to respond to a dispute. This form must have all the correct information, like Device ID and IP Address, filled in correctly. Acquirers can only try to send this form once, so it must be fully accurate before sending, otherwise it won’t be valid.

The VROL system checks if the info in the form is correct. If it is, the form goes to the issuer for review. The acquirer will only qualify for the compelling evidence solution if the info is correct. In Visa's early dispute process, banks must still agree to this form or let it expire. It usually takes 30 days. Banks can say no to this form and choose to go to arbitration if they have proof that the acquirer doesn't qualify for CE3.0. Just like today, merchants and acquirers can also go to arbitration, but there might be fees for this.

Order Insight vs. Visa Rapid Dispute Resolution

It seems like Order Insights and Visa CE3.0 can solve the dispute issues in their tracks, so for those of you who’ve been using Visa RDR, perhaps you are wondering whether this latter service is still relevant or somehow integrated into the whole process. RDR plays its own role, and it has a different scope.

RDR enables you to refund a transaction before the dispute process starts. This way, you avoid a long process and the fees that come with it. Yet this scenario is possible when the cardholder is genuinely entitled to a refund. But when the cardholder doesn’t actually deserve a refund, Order Insight and Visa CE3.0 come into play so you can prove that you are not at fault.

Source:

Source: